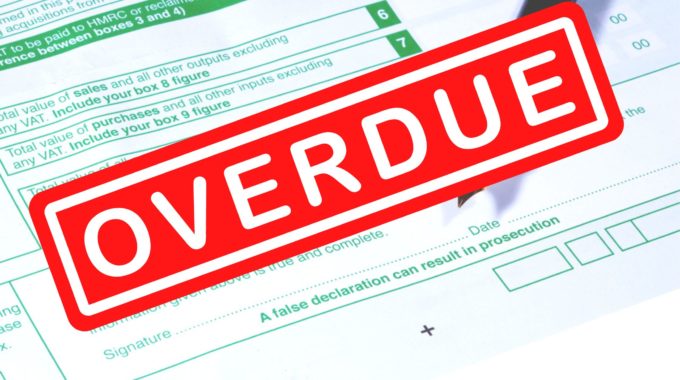

Furnished holiday lets tax regime abolished

In the 2024 budget, the Government has announced the furnished holiday lets tax regime will be abolished from April 2025 Several announcements in this week’s budget will affect property owners. Please take a moment to see if these affect you…